- Calculate Your After-Tax Income – Determine your monthly income after taxes, bonuses, and deductions.

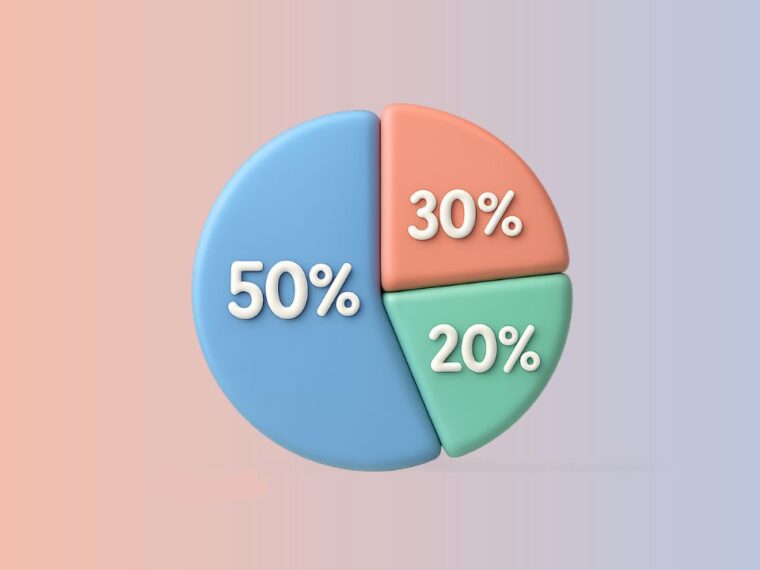

- Break It Down – Divide your income into the three categories: 50% needs, 30% wants, 20% savings.

- Track Your Spending – Use a simple app, spreadsheet, or notebook to ensure you stay within each category.

- Adjust as Needed – Life is dynamic. Adjust percentages if certain months require more for needs or if you want to accelerate savings.

- Automate Savings – Set up automatic transfers to savings or investment accounts to make the 20% allocation effortless.

- Review Regularly – Check your budget monthly and adjust for lifestyle changes or income fluctuations.

💡 Tips for Success

- Prioritize high-interest debt: Paying off credit cards or loans quickly can free up more money for wants and savings.

- Cut unnecessary expenses: Even small reductions in subscription services, dining out, or transport costs can improve financial balance.

- Use “wants” wisely: Reward yourself with thoughtful spending rather than impulsive purchases.

- Emergency fund first: Before investing aggressively, ensure you have a financial safety net.

- Stay flexible: Some months may require adjustments—don’t be discouraged if you can’t perfectly follow the 50/30/20 split.

🌟 Final Thoughts

The 50/30/20 rule is a simple yet powerful tool for anyone looking to gain control of their finances. It balances daily needs, personal enjoyment, and long-term security, all without complex calculations or rigid restrictions.

By dividing your income thoughtfully and sticking to this framework, you can reduce financial stress, achieve your goals faster, and enjoy a healthier relationship with money.

💰 Start today: calculate your income, apply the 50/30/20 split, and watch your financial confidence grow.

Pages: 1 2