Managing money can feel overwhelming. Between bills, groceries, rent, and unexpected expenses, it’s easy to feel like your finances are spiraling out of control. That’s where the 50/30/20 rule comes in—a simple, practical budgeting method that helps you take control of your money without complicated spreadsheets or restrictive rules.

This approach divides your income into three clear categories, making it easier to cover necessities, enjoy life, and save for the future.

📊 What Is the 50/30/20 Rule?

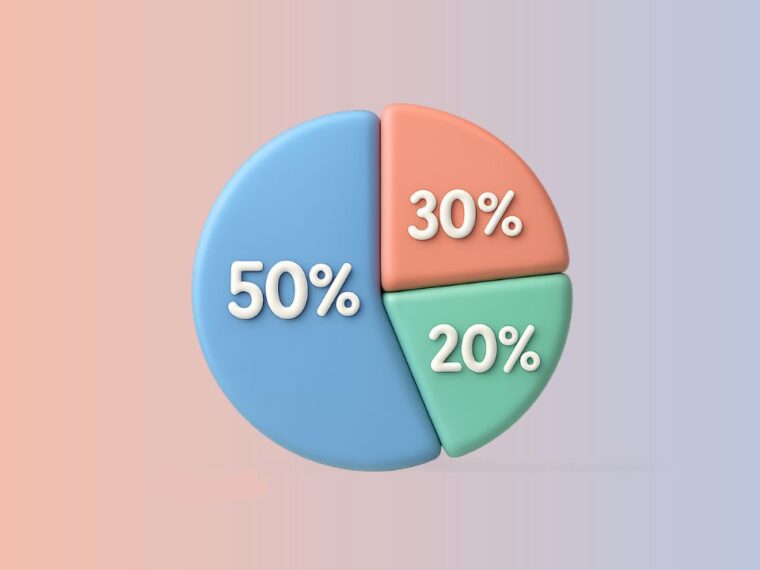

The 50/30/20 rule is a budgeting framework that divides your after-tax income into three main portions:

- 50% for Needs – essential living expenses

- 30% for Wants – lifestyle and personal enjoyment

- 20% for Savings and Debt Repayment – long-term financial security

By following this structure, you ensure that your basic needs are met, you still enjoy life, and you are actively building a stronger financial future.

🏠 The 50%: Essential Needs

The first half of your income should cover all non-negotiable, essential expenses required for daily life.

Examples include:

- Rent or mortgage

- Utilities (electricity, water, internet, gas)

- Groceries and basic household items

- Transportation (fuel, public transit)

- Insurance premiums

- Minimum loan or credit card payments

These expenses are necessary to maintain a basic standard of living. If your essentials exceed 50% of your income, it may be time to review fixed costs, such as negotiating rent, switching utility providers, or rethinking transportation options.

🎉 The 30%: Personal Wants

The next 30% is reserved for non-essential spending—things that enhance your lifestyle and happiness.

Examples include:

- Dining out and takeout

- Entertainment (movies, streaming services, events)

- Travel and vacations

- Hobbies and personal shopping

- Gym memberships or fitness classes

This category allows you to enjoy life without guilt, as long as you stay within the 30% limit. It’s important to differentiate between wants and needs to avoid overspending in this category.

💎 The 20%: Savings and Financial Security

The final 20% of your income should go toward building long-term financial stability.

This includes:

- Emergency fund (3–6 months of living expenses)

- Retirement accounts (401(k), IRA, or equivalent)

- Investments (stocks, bonds, mutual funds)

- Extra debt payments (student loans, credit cards)

- Long-term goals (home purchase, education, business ventures)

This portion is critical for reducing financial stress and increasing stability over time. Consistent saving also allows you to take advantage of opportunities or handle unexpected expenses without derailing your budget.

✅ Why the 50/30/20 Rule Works

This method is widely popular because it is:

- Simple – easy to understand and implement without detailed tracking

- Flexible – adaptable to different income levels and lifestyles

- Balanced – encourages saving while still allowing spending on enjoyment

- Sustainable – realistic for long-term use without feeling restrictive

Unlike strict budgets that require tracking every dollar, the 50/30/20 rule provides a high-level overview of where your money should go, making it easier to maintain over time.

🛠 How to Apply the 50/30/20 Rule in Real Life

Next page